By Christine A. Wu, Research Analyst, LSN

What are life science corporate venture capitals excited about these days? What is the best point of entry to get to them? How early do they invest in, and how long is the investment timeline? The Corporate Venture Capital panelists hooked a full room of entrepreneurs as they offered their intriguing perspectives at LSN’s RESI Boston conference in September.

Moderated by Donnie McGrath, VP of Business Development, Bristol-Myers Squibb, panelists include:

- Mark Powers, CFO, Integrium

- Martin Heidecker, Director & Investment Manager, Boehringer Ingelheim Venture Fund

- Ann DeWitt, Senior Director of Investments, Sanofi-Genzyme BioVentures

- Edward Hu, CFO & CIO, WuXi AppTec

Each CVC has its own unique structure.

Not one of the firms represented on the panel had the same venture structure as the other (structures listed below do not encompass all CVCs).

Dependent on the Parent Company

Traditional CVC structures, like Sanofi-Genzyme BioVentures (SGBV), make investments dependent on the context of what the parent company seeks. SGBV makes “plain vanilla” investments with no rights and no agreements, explained DeWitt, and weighs the desires of its parent company heavily as a strategic investor for the Sanofi pipeline.

Independent of the Parent Company

Boehringer Ingelheim Venture Fund invests in therapeutic platform companies outside of what BI is currently researching. The CVC is usually the first money in, and helps companies run their business plan and business agents.

Limited Partnership (LP) Agreements Only

As a drug development organization, and not a venture capitalist, Bristol-Myers Squibb (BMS) takes LP positions with venture capital firms with trusted companies, and partners with “those who are good at what they’re doing,” explains McGrath, “[we will] not to be something when we won’t be as good as others out there, so we partner with companies.”

CVC of a Large CRO with External LPs

WuXi Venture Fund invests to leverage its parent company WuXi PharmaTech, a large CRO that helps clients in product development from seed to commercial stages. While the firm enables companies to discover products more efficiently, explains Hu, WuXi also recently raised its global fund, where 25% came from capital and 75% came from Asia-based family offices.

The timeline of investment can vary.

Phase of Development

CVCs can invest as early as its first onset with just the entrepreneur and concept. Even while most WuXi investments are series A, once the license comes up, WuXi would form a company. Similarly, BI Venture Fund is usually the first money in. Heidecker describes his earliest investment was when the company didn’t even have an IP, which was unusual.

Other CVCs will invest in what makes sense at the time. SBGV will look depending on context, opportunity, and the company’s investment thesis.

Integrium, on the other hand, will only look post series C. This CVC supports financing for companies until their next inflection point. Powers explains that companies come to them, usually referenced from other VCs, when there is a piece of financing that had not shown up and is necessary for its next point of development. Integrium looks at how to get the company from one value to the next and whether it can be done in a matter of months before handing it off upstream.

Time Between Meeting the Company and Closing the Deal

It can be a fast process. Heidecker explains that the competition in the space can push the flow to the deal. Yet, the process is also fast when the CVC comes across a technology that “you just can’t invest in.”

On the other hand, it can take as long as 2.5 years before finally investing. The added element of looking for co-investors also extends the overall timeline.

CVCs are interested in lots of HOT opportunities.

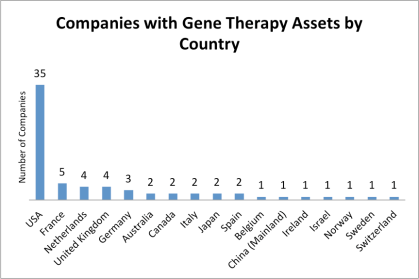

“I can get excited about many things!” both Heidecker and DeWitt exclaimed. Other than the more “common” indications of interest—such as oncology, cardiovascular, diabetes, MS, among others—panelists highlighted their particular interest in transformative therapies—therapies that fundamentally change the life of the patient, as well as microbiome and the way the immune system can crosstalk with bacteria. And then, of course, “Gene therapy is more and more hot.”

Your final advice:

- Have a clear plan – You should have a clear idea of where you want to take your company and to what level. Do you have a path (with convincing data) to your inflection points? As an entrepreneur yourself, you probably know more than anyone else. “If we don’t have this confidence, then we won’t start this conversation,” says Hu.

- Be introduced through CVC leadership – the best point of entry is when you directly have a relationship with someone inside the leadership team and are introduced.

- Establish some type of credibility – whether a paper publication, an academic fund, an established CEO, mark yourself.

- Have a perfect 30-second pitch – “It’s amazing how crisp you can be in 30 seconds to tell us what it is you’re about and why we should continue our conversation,” says DeWitt.

- Don’t be married to your protocol or approach – When you and the CVC convert to the clinical setting, generally things will change 90% of the time.

- And finally, “If my group says no, don’t go to my boss!” McGrath concludes.