As a sponsor of RESI JPM, Novotech joined the RESI community during JPM Week to engage with emerging biotech companies at pivotal stages of development. Marina Mullins, VP of Early Clinical Development at Novotech, shared insight into the company’s biotech-focused model, global execution strategy, and evolving approach to early-phase clinical development.

Caitlin Dolegowski (CD): Can you briefly describe Novotech’s mission and core capabilities as a global CRO and scientific advisory partner?

Marina Mullins(MM) : Novotech is a global full-service clinical research organization and scientific advisory partner focused on accelerating the development of innovative therapeutics for biotech and small- to mid-sized pharmaceutical companies. The company provides integrated clinical trial services across Phase I–IV, with particular strength in early clinical development, regulatory strategy, medical oversight, biometrics, and operational execution.

With offices across Asia-Pacific, North America, and Europe, and long-standing site partnerships globally, Novotech combines regional expertise with global coordination to support sponsors from preclinical planning through proof-of-concept and beyond. Its model integrates scientific advisory and operational delivery, enabling sponsors to move efficiently from strategy to execution.

CD: What differentiates Novotech from other CROs in terms of clinical execution, expertise, or client support?

MM: Novotech differentiates itself through a biotech-centric approach and deep regional execution expertise. Rather than operating as a transactional service provider, the company works as a strategic partner, aligning development strategy with operational planning from the outset.

Key differentiators include strong early-phase capabilities, particularly in first-in-human and proof-of-concept studies; deep regulatory and operational experience across high-performance regions such as Australia, Asia, and North America; therapeutic expertise spanning oncology, infectious diseases, obesity, CNS, endocrine, rare diseases, and emerging modalities; and a partnership model designed to provide agility, senior oversight, and milestone-aligned execution.

This integrated structure allows sponsors to make data-driven decisions while maintaining timeline discipline and regulatory alignment.

CD: How does Novotech’s global footprint support biotech and pharma companies as they advance clinical development?

MM: Novotech’s global presence enables sponsors to strategically select development regions based on speed, regulatory pathway, patient access, and capital efficiency.

For example, Australia offers an established regulatory framework that allows certain first-in-human studies to proceed under the Clinical Trial Notification scheme without requiring an Investigational New Drug submission to the U.S. Food and Drug Administration. This can provide an efficient pathway to first patient while maintaining internationally recognized ethical and regulatory standards.

At the same time, Novotech’s footprint across Asia, North America, and Europe supports seamless program expansion into multi-regional trials. Sponsors benefit from consistent governance, harmonized data standards, and coordinated regulatory strategy as programs advance.

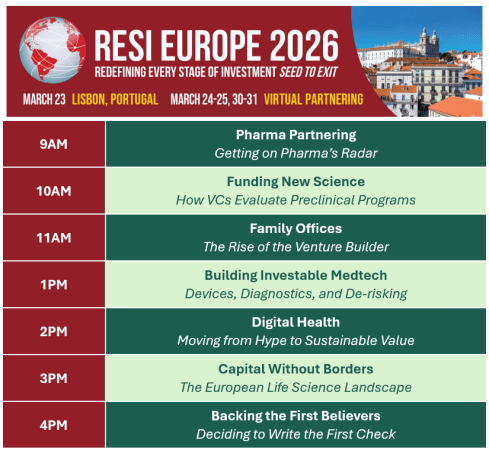

CD: As a sponsor of RESI during JPM Week, what were your key objectives for participating this year?

MM: Novotech’s objectives were centered on early engagement and strategic dialogue. The company aimed to connect with emerging biotech companies preparing for first-in-human or proof-of-concept studies, provide guidance on early development strategy and regulatory pathways, explore long-term partnerships beyond single studies, and support investor-backed companies in aligning clinical milestones with financing objectives.

RESI provided a focused environment to engage with innovative sponsors at critical inflection points in development.

CD: Who is Novotech most interested in connecting with?

MM: Novotech is particularly interested in engaging with early- to mid-stage biotech companies transitioning from preclinical to first-in-human studies, and companies seeking an integrated CRO partner that combines regulatory advisory, scientific strategy, and operational execution. The emphasis is on building strategic relationships with sponsors who value early alignment between scientific design, regulatory positioning, and clinical operations.

CD: Are there particular trends in early clinical development shaping Novotech’s ECD strategy?

MM: Regulators are placing greater emphasis on optimized dose selection and robust early-phase data packages, increasing the use of adaptive designs, expansion cohorts, and integrated pharmacokinetic and pharmacodynamic modeling in first-in-human studies.

There is also growing strategic use of healthy volunteer studies, where scientifically appropriate, to better characterize safety, pharmacokinetics, and target engagement before patient expansion. This can reduce downstream risk and improve capital efficiency.

Biotech sponsors are under pressure to generate milestone-defining data efficiently. As a result, early programs increasingly incorporate translational biomarkers, seamless SAD and MAD structures, and optional proof-of-concept expansion pathways within unified protocol frameworks.

Together, these trends reinforce a shift toward positioning early clinical development as a strategic foundation for the entire program lifecycle.

Interested in sponsoring an upcoming RESI conference?

To explore sponsorship opportunities, please contact resi@lifesciencenation.com. Life Science Nation would welcome the opportunity to meet and discuss organizational goals for connecting with the global RESI investor and innovator community.

Tags: AI, art, artificial-intelligence, beauty, books, business, cooking, digital-marketing, exercise, fitness, food, health, hotels, inspiration, lifestyle, makeup, mental health, news, nutrition, photography, recipes, restaurants, science, technology, travel, weight-loss, wellness, writing