By Michael Quigley, Director of Research, LSN

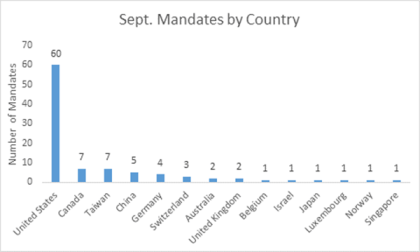

This September, LSN’s research staff managed to speak with and get mandates from 96 life science and healthcare investors from 15 countries all around the globe. As we have grown in the space over the past 3 years we are continuing to see more and more investors, particular from Asian countries like China (especially Hong Kong) and Taiwan with interests in investing in healthcare outside of their region. Figure 1 shows a breakdown of the countries where the investors we spoke with last month are based:

Interestingly 75% of the mandates from Asia-based investors are looking for emerging technologies either globally, or to the US in addition to their local geographies. This is a trend that we have commented on in the past, and are seeing continue to grow and materialize as we speak with more and more investors.

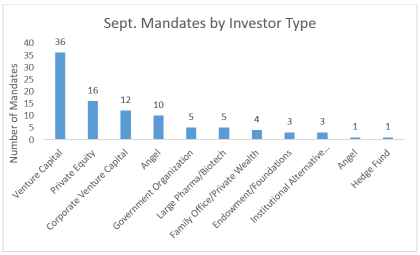

In addition to the geographic breakdown of investors LSN’s research team spoke with last month, there was also diversity in the types of investors contacted.

This spread of investor types highlights an ongoing theme expressed by LSN; reaching out to one or a few types of investors is going to greatly limit your chances of receiving an allocation. As we have said time and time again, fundraising is a numbers game. You want to start with a wide net and work your way through a target list to ensure you leave no stone unturned.

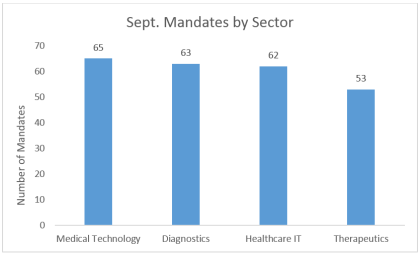

The spread of sectors these investors LSN’s research team spoke with in September are looking to invest in was fairly even, with medical technology, diagnostic and healthcare IT outpacing therapeutics by around 20%. This is a result of many investors including a number of large tech firms that we speak with that simply do not have the expertise or appetite to invest in the complex and time intensive realm of therapeutics yet still want exposure to healthcare innovation.

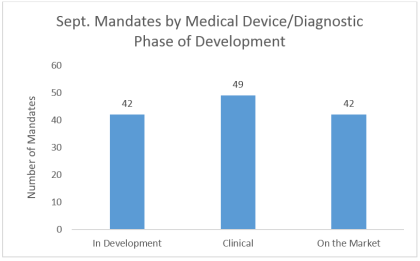

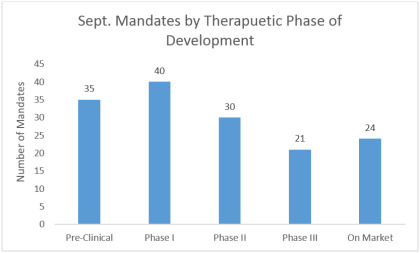

LSN’s Research team focus on finding and speaking with investors looking for early stage companies. Interestingly across devices, diagnostics and therapeutics, investors seem to be most interested in companies that are obtaining their first-in-man data. These assets often see large spikes in valuation at the end of their first clinical studies or when showing early signs of efficacy in humans, so it’s logical that early stage investors target their allocations at this particular development point.

While this roundup provides an overview of the information we have recently gathered regarding investor interest, we collect many other details that help us identify suitable opportunities for each investor, including which indication areas and technological approaches the investor focuses on, and what kind of financing rounds the investor is open to participating in. These details are invaluable to a life science company looking to find the right investor fit. We look forward to speaking with more life science investors and continuing to share our findings with our readership.