By Dennis Ford, Founder and CEO of Life Science Nation

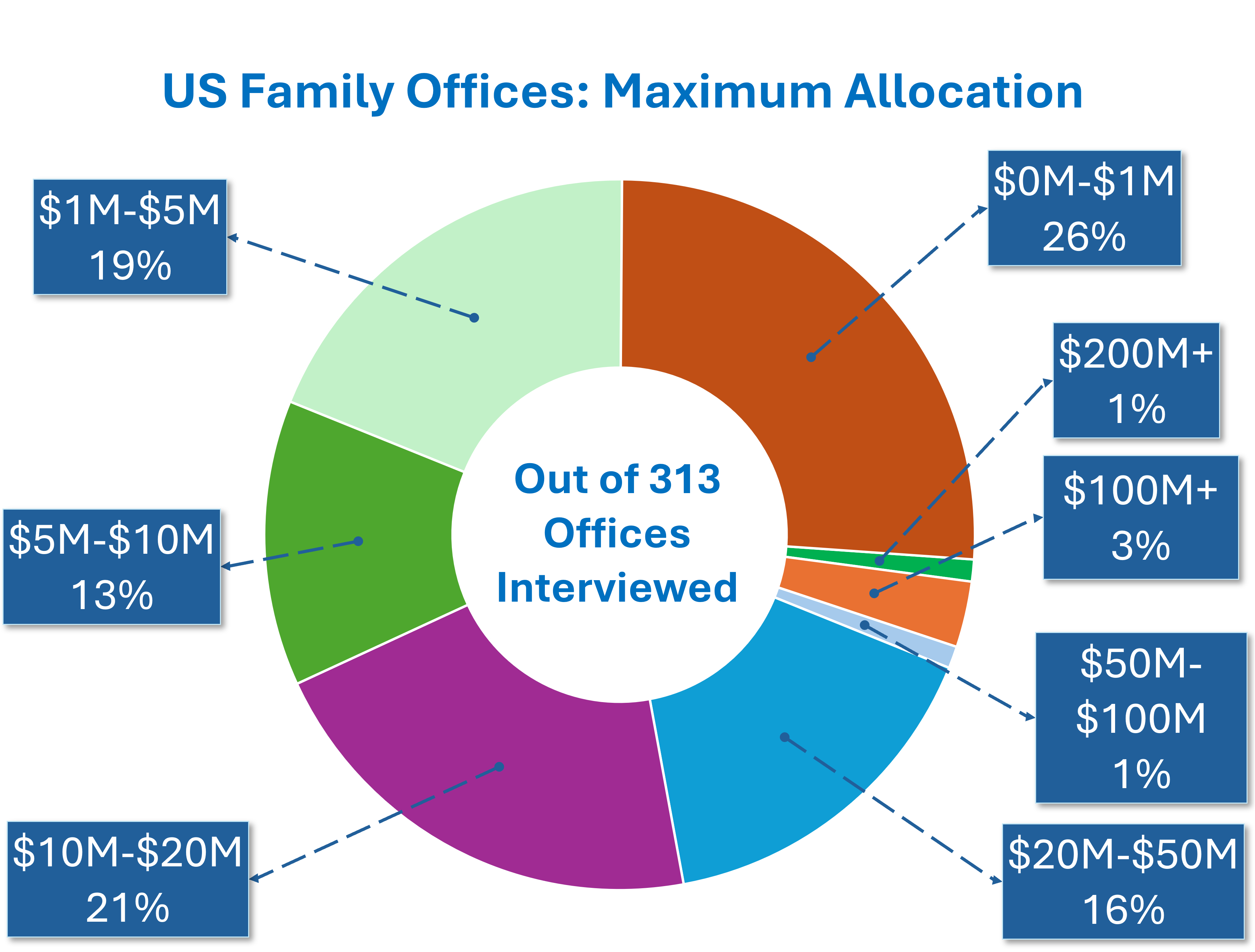

Family offices are emerging as influential investors in the early-stage life sciences sector, leveraging their unique position to support innovation while seeking promising financial returns. Register for our free virtual family office panel. These investment entities align their strategies with personal values, contributing to healthcare advancements and enhancing their families’ legacies. As the life sciences sector evolves, the collaboration between family offices and early-stage companies is expected to grow, potentially leading to significant societal impacts. Life Science Nation curates one of the largest databases of family offices that focus on the healthcare arena, with over 700 offices. The most prominent family offices have the potential to distribute allocations exceeding $100M, though most, a remarkable 95% fall into the Seed, Series A, and Series B with mandates to allocate between $250K to $50M, which bodes well for the early-stage companies.

Family offices are emerging as influential investors in the early-stage life sciences sector, leveraging their unique position to support innovation while seeking promising financial returns. Register for our free virtual family office panel. These investment entities align their strategies with personal values, contributing to healthcare advancements and enhancing their families’ legacies. As the life sciences sector evolves, the collaboration between family offices and early-stage companies is expected to grow, potentially leading to significant societal impacts. Life Science Nation curates one of the largest databases of family offices that focus on the healthcare arena, with over 700 offices. The most prominent family offices have the potential to distribute allocations exceeding $100M, though most, a remarkable 95% fall into the Seed, Series A, and Series B with mandates to allocate between $250K to $50M, which bodes well for the early-stage companies.

Family Office Panel at RESI Boston

Several Family Offices will share their insights on early-stage investments at the upcoming RESI conference on September 25th at the Westin Copley, Back Bay, Boston. Notable speakers include Michael Langer, Co-Founder & Managing Partner of T.Rx Capital; Sunil Shah, Co-Founder of o2h Group and CEO of o2h Ventures; John Parker, Founder of Springhood Ventures; John Abeles, General Partner at Northlea Partners; and David Prim, Senior Associate at Broadview Ventures. This event will provide an opportunity to learn about investment themes and strategies from seasoned family office investors.

Michael Langer Michael LangerCo-founder & Managing Partner at T.Rx Capital |

Sunil Shah Sunil ShahCo-founder of the o2h Group and CEO of o2h Ventures |

John Parker John ParkerFamily Member and Trustee of the Charles Hood Foundation and Founder of Springhood Ventures |

John Abeles John AbelesGeneral Partner of Northlea Partners |

David Prim David PrimSenior Associate of Broadview Ventures |

The Appeal of Life Sciences

Investing in early-stage life sciences is attractive for several reasons. The sector is marked by rapid innovation and growth, offering the potential for substantial financial returns. Breakthroughs in biotechnology, pharmaceuticals, and medical devices can increase significant valuation for successful startups. With market volatility affecting traditional investment avenues, family offices are turning to life sciences to diversify their portfolios. The healthcare sector often behaves differently from other industries, providing a buffer against economic downturns. Many families have personal connections to healthcare, whether through family members who are healthcare professionals or personal experiences with illness. Thus, investing in life sciences offers financial rewards and allows families to contribute positively to society by supporting innovations that can improve health outcomes.

Family Office Strategies for Investing

Family offices employ various strategies when investing in early-stage life science companies. Some invest directly in startups, providing capital, strategic guidance, and mentorship, allowing them more control over their investments and the opportunity to influence the direction of the companies they support. Others invest in specialized venture capital funds focusing on life sciences, leveraging the expertise of experienced fund managers to identify high-potential startups and provide the necessary support for their growth. Collaboration with other investors or family offices is common, as they share resources and insights to reduce risk and enhance opportunities, leading to joint ventures or co-investments in promising life science enterprises.

Investor Fireside Chat – Strategies for Family Office Investments

Join our free Family Office webinar on August 20th at 1PM ET to hear how to find and approach family offices, and what assets are most interesting to them.

| August 20, Family Office Webinar – Free Sign Up | |

| 1 PM | Investor Fireside Chat – Strategies for Family Office Investments – Claire Jeong, VP of Investor Research, LSN (Moderator) – Katherine Hill Ritchie, Founder, Private Capital Investments, LLC – Ron Paliwoda, Founder and President, Paliwoda Group – Shubhra Jain, Principal, Head of Healthcare Investments, Tarsadia Investments – Bryan Grulke, Partner, Volcano Capital |

Leave a comment