By Max Klietmann, VP of Marketing, LSN

Now that you’ve done your research on the investors you intend to target, it’s time to start dialing for dollars. But the most important stage of the planning process is anticipating both what you will say and how you will pitch your company. Investors get solicited by hundreds of companies a week, and generally have very tight schedules. Separating yourself from the other life science companies that contact these investors on a daily basis is vital to making an impression and starting a meaningful dialogue.

At this point, even very competent, outgoing, and savvy entrepreneurs can feel intimidated, discouraged, and afraid. Outbound marketing is hard work, and can be disheartening if you don’t invest time in preparing your pitch so that you can confidently pick up the phone and explain why you are an ideal prospect for an investor.

Your first step is to draft a concise and powerful elevator pitch that includes who you are, the reason for your call, and what your distinctive value proposition is – in short, what differentiates you from you competitors. You should get your initial pitch down to around one minute. Most deal sourcing executives or the individuals who head up direct investments have a thousand things to get done during their workday; listening to your pitch is most likely the last thing on their priority list, so you need to make the time while you hold their attention count. Remember to keep your pitch succinct, but be sure to hit on the key points, and make sure that you follow up in an email with your investor deck.

Once you have your pitch down, it’s time to call up the investor. Here it is important to be extremely on-point and have the ability to be attentive enough to pick up on the investor’s mood. Investors may frequently seem short or rushed on the phone; if this is the case, then you need to make sure that you cut to the chase in terms of your value proposition. If the investor seems cheerful, then a lengthier approach may be appropriate. Just as no investor is the same, every conversation that you will engage in will be a little different, so being able to adapt quickly to the tone of the call is invaluable.

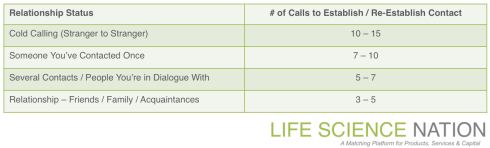

Believing that you will be able to reach a prospective investor on the first try is a common fallacy. The number of life science companies that are trying to engage these investors is staggering. You will most likely get the investor’s voice mail, or be asked to leave a message with the secretary. Now you’re faced with another quandary – to leave a message or not to leave a message? If you have the individual’s direct number and you were not transferred over by the company’s administrative assistant, then it is sometimes best to just try back at a later date.

However, sometimes leaving a voicemail does prompt a call back, so you may want to opt to leave an introductory voicemail. You should try to be even more succinct in your voicemail than your elevator pitch, so try not to leave voicemails exceeding thirty seconds. Also, always follow up with an email after your voicemail so the investor has your email address as well in case they prefer that mode of correspondence, which we at LSN have found is generally true of larger more institutional investors.

However, sometimes leaving a voicemail does prompt a call back, so you may want to opt to leave an introductory voicemail. You should try to be even more succinct in your voicemail than your elevator pitch, so try not to leave voicemails exceeding thirty seconds. Also, always follow up with an email after your voicemail so the investor has your email address as well in case they prefer that mode of correspondence, which we at LSN have found is generally true of larger more institutional investors.

A week passes and you still haven’t gotten a follow up e-mail or phone call. This should not come as a surprise to you. Many life science fundraisers will simply assume that the investor is not interested in their company and will give up trying to get this investor on the phone. This assumption is completely incorrect. To be successful at raising capital, you need to be determined. This doesn’t mean that you should be pushy – but it means you need to be very diligent in your follow up process. You need to try to give the investor a call again, and leave another voicemail. The message you leave should reference the last voicemail that you left, as well as the follow up email that you sent previously.

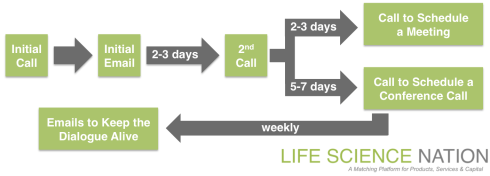

An example of how to structure your outreach

An example of how to structure your outreach

Don’t fall into the rut of leaving messages with the investor’s administrative assistant. Many fundraising executives make the mistake of leaving their information with a secretary call after call. Instead of simply giving the assistant a message for the correct contact at the firm, start a dialogue with the assistant. Make sure you make a note of their name and next time when you call back be sure to say their name and start a conversation. You can talk about anything – even the weather to start a dialogue. The administrative assistant may open up after you engage them in conversation and give you valuable information that will help you contact the person next time you call.

Some executive assistants will not want to chat no matter how hard you try to get them to speak with you. If that is the case, just mention the fact that you have called a number of times and ask if e-mail is the best way to correspond with the person. You can’t just dial a number and expect to get the person on the phone. As a fundraising executive, you need to think outside of the box in order to get the right person on the phone, no matter how long it might take you.

Leave a comment