By Lucy Parkinson, Director of Research, LSN

2016 has been a mixed year for pharma, with new drug approvals well down from the 2015 highs, but major pharma firms continue to search outbound for the drugs of the future. The LSN Licensing Deals Platform provides detailed information on announced pharma deals, and this data allows us to take a look at the overall dealmaking landscape in 2016.

The LSN Licensing Deals platform doesn’t include M&A, and only covers deal announcements in which some financial information was stated, such as upfront and milestone payment amounts and/or a royalty percentage. In 76% of cases, the data includes an upfront payment amount; these varied considerably, with some preclinical deals providing under $1 million in immediate cash, and some Phase II and Phase III deals bringing in hundreds of millions.

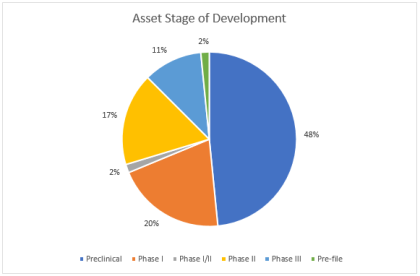

Most 2016 Deals Were Preclinical

Among deals in which an asset stage of development was stated, preclinical assets were by far the most common, featuring in almost half of these deals. This figure has shot up since 2015. In an increasingly competitive arena, major pharma firms inked deals early.

Oncology Remains Supreme, Digestive Interest Increases

In deals in which a single specific disease area was identified, oncology opportunities predominated, exceeding other major fields of medicine by several times over. In surprise second place came the digestive system, with a 50% increase in reported deals over 2015. Other popular fields include neurology, dermatology, ophthalmology and musculoskeletal disorders.

Both New Innovations And Mainstays Attract Deal Interest

For many deals, the LSN Licensing Deals Platform describes the type of technology involved in the transaction. Some are widespread, while others are in a class of their own. There’s still a considerable amount of interest in antibody innovations, with over 20% of all deals involving an antibody. Antibody technologies were primarily either monoclonal or bi-specific antibodies, with several other types of antibody technologies being shopped, such as antibody-drug conjugates.

T-cell technologies (including CAR-T) continue to attract interest. However, so do kinease inhibitors, proving that this small molecule approach is not yet ‘yesterday’s science’ . Other technologies that remain sought after include RNA therapeutics and drug delivery technologies.

There’s A Lot Of Fish In The Sea

As ever, you won’t be surprised by the names of the most prolific licensees in the dataset (it’s evens between Roche, Merck and Bristol-Myers-Squibb, with other well-known global pharma firms very close behind them). However, over 70 pharma firms, located in every corner of the globe, announced a licensing deal last year. If you’re looking for a strategic partner for your asset, it’s worth hunting beyond the top 10 or even top 50 largest firms. The LSN data platforms provide detailed information on potential development or exit partners far outside that mainstream.

Leave a comment