By Lucy Parkinson, Research Manager, LSN

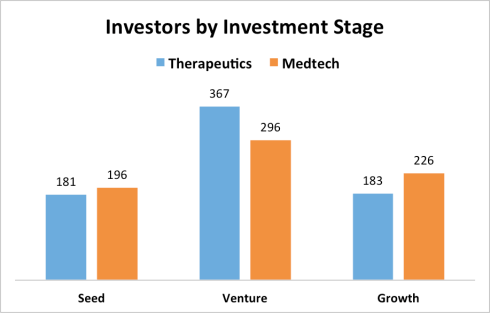

As highlighted in our look at the Medtech Fundraising Landscape for 2014, LSN Research contacted investors from across the medical device map. The results show that there are more active investors in the medical device sector than in therapeutics, despite opinion to the contrary. However, we have seen a marked difference between these two groups of investors – while therapeutic investors are more likely to be focused on early stage companies, medtech investors are distributed more evenly across a company’s lifespan. The chart below shows the respective distributions of investors among LSN’s mandate data:

So when it comes to early stage companies, you may well find there is more interest in therapeutics than in devices. However at the growth phase, you’ll find many investors taking an interest in more mature medical technology opportunities. Many investors are only looking for companies with substantial revenues, but some we’ve spoken with also look at commercialization-stage opportunities; that is, devices that have regulatory approval and need investment to scale their manufacturing and marketing.

Here are some of the reasons that investors have given for their interest in later-stage medical device opportunities:

- “We’ve had success investing in healthcare.” These investors have previously invested in clinics and healthcare providers, and this familiarity with the marketplace gives them confidence that they can make the right bets in the medical device space. Some of these investors may never have backed a device company before, but they’re receptive if the bottom line is right. LSN Research hears this perspective from family offices and from healthcare-focused PE funds.

- “We don’t have the capacity to invest in drug development.” These investors are eager to invest in healthcare technologies and they’re prepared to put commercialization capital into a new product, but the capital requirements of late-stage therapeutics are beyond them. Smaller PE funds elucidate this approach.

- “We know the business, but we don’t have a medical expert on staff.” These investors have expertise in other relevant sectors (such as niche manufacturing or sales) but they do not feel they can accept scientific or regulatory risks. They need assurance from a regulator that the product is scientifically sound, but with that taken care of they’re interested in applying their other skills to the early growth of a device company. Experienced generalist PE firms state this angle on the medical device sector.

- “We’re industry agnostic, but here are our other requirements.” These generalists are looking for companies that match fixed requirements such as a revenue figure, or a headquarters in the investor’s region. While they might be willing to invest early, they will want to see evidence that your product has market traction. They’re willing to consider any industry provided the company’s within their ballpark. Many debt funds that provide financing for medical device companies fit this description, as do many regional PE firms.

LSN Research consistently found that many growth investors who, on the surface, don’t have a life science focus are in fact open to medical device opportunities. If you’re looking for funding for a device, you never know who it might be worth speaking to, so cast your net wide.

Leave a comment