By Dennis Ford, CEO, LSN

Everyone is familiar with the tale of the emperor who cares only to show off his gorgeous fine attire. As the Hans Christian Anderson tale goes, he hires two tailors/swindlers who claim to make the finest clothes that are rendered invisible to anyone unfit for his/her position, or not smart enough to see the garments. Of course, being swindlers, they put on a grand spectacle, collect their fees, and leave the emperor with his invisible clothes. The emperor’s ministers know there are no clothes, but pretend to see them for fear of being deemed incompetent and the townspeople play along for fear of losing their positions. Finally, a child too young to understand the dynamic blurts out the truth. Soon enough, it is then picked up by the crowd that the “emperor has no clothes” and when the emperor hears the chorus realizes his folly but proceeds on anyways.

This little parable echoes in the back of my mind when I survey the fundraising landscape and talk with the myriad of “fundraising tailors.” Please keep in mind that in every category you have great super professional firms that can and will do what they say but on the other side of the coin you have the good the bad and the ugly. All pontificate about how money is raised, and what scientists need to do. In fact, many of them make quite a compelling pitch and value proposition, which can make it difficult for even seasoned life sciences entrepreneurs to accurately gauge how much (or how little) value these constituents really offer. Call me naïve, but what is being preached often simply doesn’t reflect reality. The emperor has no clothes!

I recently spoke with a few go-getter Scientist/CEO/Entrepreneurs that have enough experience in the space that I trust their opinions, and I asked them to identify all the players that they are utilizing (or have utilized) fund-raising efforts. Fasten your seatbelts for the cast of characters I am about to introduce you to:

The Finder & The Sourcer

This category claims the ability to source capital via special high-end personal networks. They come in two flavors – Either they have some technical expertise that allows them to vet deals, so that when they present an opportunity to someone with capital, they can claim to have gone through a first due diligence pass of sorts (The Sourcer). The other type claims connections in the “right places” through word-of-mouth, and their specialized connections can get you into introductory meetings with people who have money (The Finder). The right sources could be an investment bank, VC, family office, etc. However, they often claim that they are the only access point, and only they possess the inside knowledge required to reach these investors. Finders and Sourcers will find you at seminars/symposiums/conferences that revolve around informing or guiding entrepreneurs about how to raise funds. Either of these constituents can charge you for general services, charge for meetings, or get a piece of a deal – or a combo of all three.

The Third Party Marketer

The 3PMs, as they are referred to, come in two flavors as well – One that is a legitimate broker-dealer, meaning that they are blessed by the SEC and FINRA to represent a firm and be part of a transaction that involves the selling of securities. The other type of 3PM isn’t officially licensed but does it anyway. I do not know what the ratio is for licensed versus non-licensed 3PMs, but I would imagine it have to be around 50 to 1. The 3PM makes their money through a monthly stipend plus a success fee in the form of a cut of the money they raise.

Investor Conference Providers

These folks will typically charge you a fee to go to a preset/prequalified meeting with an alleged C-type executive or someone with a title who can do a deal. In these types of scenarios, if it sounds too good to be true, then it probably isn’t true. The word on the street is that a person from a well-known firm or institutional investor will be there, but typically not the person you would want to meet. Caveat emptor!

Investment Banks

The I-banks are typically certified broker-dealers, and do have access to life science entrepreneurs and a myriad of investors – some specializing in high net worth individuals, family offices, and institutional connections as well. The trick here is vetting and establishing a compelling relationship with the right I-bank. We’ve spoken about how to successfully do this previously, but at the most basic level, find an I-bank that is specialized and has access to the right kind of clients.

So Who is on the other side of the transaction? Here’s an overview:

The VC

We’ve discussed the unfortunate trend surrounding VC’s extensively, but in short – barring a few major players – the money is dried up and the terms can be predatory. The myth, of course is that this is the go-to source of capital after friends, family and angels.

The Institutionals

These are the foundations and endowments with a mandate to invest in life sciences. They are often indication-motivated and have the intention of moving science forward. These can make an excellent partner if you can identify the right ones due to their motivation to quickly push product to market.

Family Offices

These are wealthy families that have “gone institutional” and are making direct investments into life science companies. Typically, they are indication-motivated as well, and tend to invest with a long-term perspective. This category also includes patient groups backed by wealthy individuals and families looking to resolve specific diseases within their families. They are top notch partners, but can be tough to identify – LSN provides a database of family offices active in the space.

Mid-Stage PE & Virtual Pharma

These constituents have gotten smart, watched industry trends, and have begun to aggregate pools of assets around specific disease areas or molecule types. They are getting in early and shepherding them through clinical trials as efficiently as possible. The endgame is either spinning a portfolio into a large pharma with a dry pipeline, or using a rent-a-salesforce distribution model to bring product to market. These can be a very efficient capitalization option, but be careful – they are not idle, so don’t stand by!

The Strategics

Big pharma & corporate venture capital are the primary players here. The name of the game is scouting for assets that fit the strategic orientation of the company. This can take the form of a large pharmaceutical company looking to fill a pipeline gap, or a more non-traditional scenario such as a high tech company looking for an opportunity to enter the medical device space. They can be a great resource due to large budgets and infrastructure that can be put at your disposal.

The critical piece in the whole process is finding out how to effectively navigate the space without getting stuck in the mud or shelling out unnecessary fees for minimal value. This is where a roadmap becomes a key asset. Please remember the aforementioned parable, and be aware of what it teaches… People should have their own opinion and not depend solely on other people; the two tailors earned a lot of money without doing anything. The emperor pretends to be important but only worries about his clothes. For me, the big take away is preserve a bit of your child honesty and remember that if it sounds too good to be true, it probably isn’t.

Lastly, as I have stated before, having a current accurate roadmap is paramount. The database you choose to work with can be either the most efficient way to secure the right investor, or the ultimate waste of money. This is your roadmap to the landscape, but not all maps are created equal – far too many people are relying on outdated information that will get you nowhere. There are three critical pieces to focus on: Freshness, accuracy, and a forward-looking perspective. Freshness is critical, because the investor landscape is changing so rapidly, that data is very quickly outdated. VCs are dead or dying, government funding is shriveling up, and hardly anyone can identify the emerging opportunities for capital. Accuracy is critical, because almost no investor databases get their data from the horse’s mouth, which makes many investors identified as “fits” irrelevant. Finally, there is the issue of forward-looking perspective – this means a mandate of what investors are looking for, not a record of what they have invested in in the past. But be wary if considering a database, as they are certainly not all created equal.

By using the right database and working with the right partners, raising capital can be efficient, strategically aligned with your firm, and will make you more successful in your endeavor. However, it is critical to use the right map, and call things as they are. Too often, great ideas don’t make it to market, because no one is willing to say “the emperor has no clothes!”

Tags: biotech, biotechnology, CMO, consulting, CRO, family offices, Fundraising, investor, Investors, issue, letter, life, Life Science, life science nation, medicine, nation, news, newsletter, pharma, Pharmaceutical, private equity, research & development, science, startup, venture capital

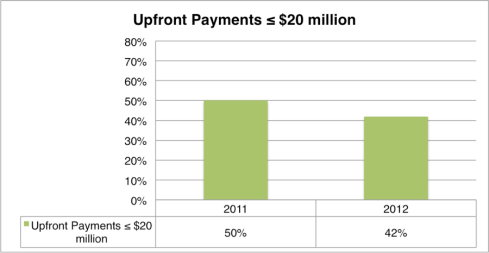

Upfront payment sizes increasing: The number of deals surrounding discovery stage assets with an upfront payment of $20 million or less as part of the terms decreased from 50% to 42%. This translates to a significant increase in deals with large upfront payments, reflecting the trend that LSN identified a few months ago of Big Pharma looking closer to the source when it comes to in-licensing assets.

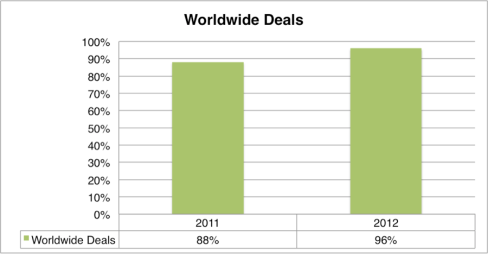

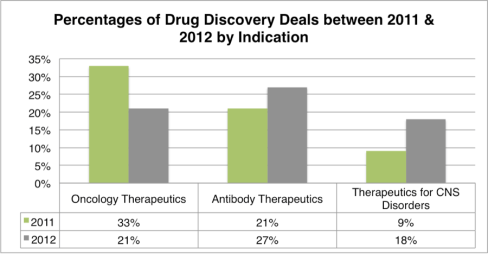

Upfront payment sizes increasing: The number of deals surrounding discovery stage assets with an upfront payment of $20 million or less as part of the terms decreased from 50% to 42%. This translates to a significant increase in deals with large upfront payments, reflecting the trend that LSN identified a few months ago of Big Pharma looking closer to the source when it comes to in-licensing assets. CNS is one of the hottest indication areas: Among a number of shifts in primary indication areas associated with deal activity was a huge increase in CNS deals. The percentage of CNS deals effectively doubled year-on-year, suggesting that this is trending towards becoming one of the hottest activity sectors (soon to overtake oncology, which has seen a downward trend in deal activity).

CNS is one of the hottest indication areas: Among a number of shifts in primary indication areas associated with deal activity was a huge increase in CNS deals. The percentage of CNS deals effectively doubled year-on-year, suggesting that this is trending towards becoming one of the hottest activity sectors (soon to overtake oncology, which has seen a downward trend in deal activity). In summary, there is an increase in licensing activity surrounding discovery stage assets as a whole, an improvement in deal terms at this development phase as a whole, and a significant increase in activity surrounding CNS drugs. These trends will have a resounding impact on industry dynamics, and are critical for savvy players in the space to take into account.

In summary, there is an increase in licensing activity surrounding discovery stage assets as a whole, an improvement in deal terms at this development phase as a whole, and a significant increase in activity surrounding CNS drugs. These trends will have a resounding impact on industry dynamics, and are critical for savvy players in the space to take into account.