By Antoinette Lowre, Manager of Business Development, LSN

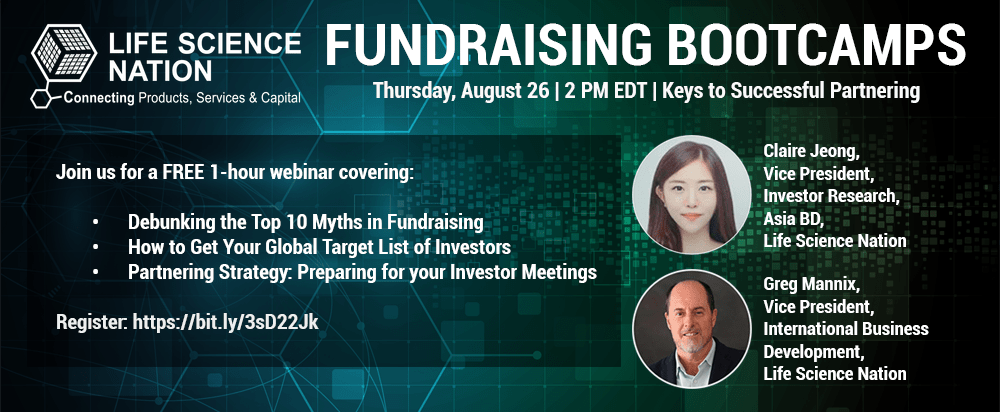

Digital RESI returns in a virtual partnering format June 7-9. To prepare Life Science Nation’s network of startup founders and scientist-entrepreneurs to partner with the 400+ investors and strategic partners expected at this upcoming RESI, we are pleased to offer complimentary fundraising bootcamps. These 1-hour webinars dive into different topics pertaining to early-stage fundraising and digital partnering through the RESI platform. They also include sessions on the Innovator’s Pitch Challenge – one of the most popular and competitive events at RESI.

Check out details below and register to join a free fundraising bootcamp to support your current or next raise!

|

Tuesday, April 5, 2PM EDT

|

|

|

Branding & Messaging: Seed to Series B

|

|

To win capital, you must stand out from the crowd. The first way to do that is to have top-notch marketing collateral. This bootcamp discusses how to provide potential investors with high-quality, professional materials—materials that engage them, communicate your message clearly and concisely, and present the information they want to see in a way that helps them to decide quickly and easily if you are a potential fit for their needs.

|

|

|

Tuesday, April 12, 2PM EDT

|

|

|

Preparing to Pitch at RESI

|

|

The Innovator’s Pitch Challenge (IPC) is an opportunity for early-stage companies to gain additional exposure to conference attendees, pitch directly to a panel of relevant investors, and participate in a live Q&A session. This bootcamp will walk through the process of preparing your pitch materials and what to expect in a live pitch session, including frequently asked questions from investor judges.

|

|

|

Wednesday, April 20, 11AM EDT

|

|

|

Fundraising 101: Avoiding Pitfalls and Improving the Odds

|

|

This bootcamp is designed to help scientist-entrepreneurs navigate the world of fundraising. It starts out by debunking some commonly held misconceptions about early-stage startups and fundraising, followed by tips on how to improve your chances and increasing investor visibility.

|

|

|

Wednesday, April 27, 1PM EDT

|

|

| Preparing to Pitch at RESI | |

The Innovator’s Pitch Challenge (IPC) is an opportunity for early-stage companies to gain additional exposure to conference attendees, pitch directly to a panel of relevant investors, and participate in a live Q&A session. This bootcamp will walk through the process of preparing your pitch materials and what to expect in a live pitch session, including frequently asked questions from investor judges.

|

|

|

Wednesday, May 4, 2PM EDT

|

|

|

Strategies for Successful Partnering

|

|

This bootcamp is a fan favorite with tried-and-true tips to make your partnering experience exceptional, letting your technology, product, and team take center-stage. Whether booking 1-on-1 meetings or pitching to a panel, these strategies will help you prioritize the details that make a difference in telling your story to potential investors and strategic partners.

|

|