By Dennis Ford, Founder & CEO, LSN

LSN is laser focused on the early stage investment dynamic; the ever changing relationship between buyer and seller, between investor and fundraising CEO/scientist-entrepreneur. LSN staff program the content to be specifically about investors detailing their investment processes to the entrepreneur audience – RESI’s panels and workshops are selected for relevance to early stage investment.

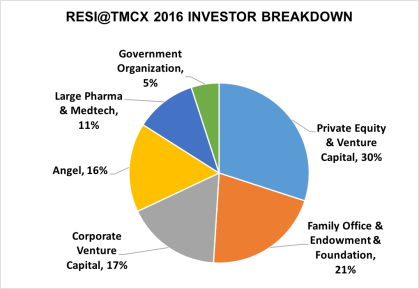

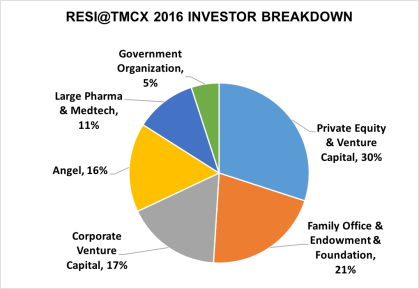

After the investor landscape morphed, LSN created RESI to be a venue to feature all the players in the early stage investment arena. LSN tries hard to present current state-of-the-state content relevant to the investor marketplace. It’s not just about venture capital firms; there are nine other categories of investor that LSN invites to RESI, including Angels, Corporate VCs, Family Offices, Large Pharma/Med Device corporations, and Foundations. With VCs turning toward later-stage, derisked opportunities, it’s important for early stage companies to meet a broader group of investors that still have appetite for preclinical assets.

RESI is a hub in this new landscape, and while VCs are still an important part of this ecosystem, RESI aims to tell a wider story. I’ve received great feedback from attendees from throughout this ecosystem; LSN is proud to have created an event that yields a positive response from such a wide variety of early stage companies and investors.

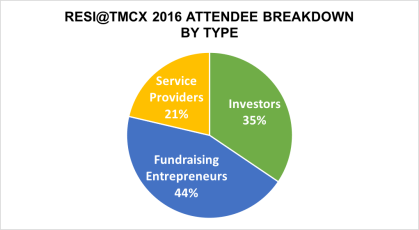

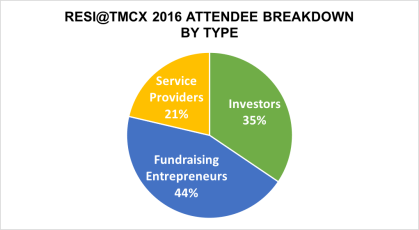

Metrics for RESI @ TMCx

Breakdown of investors at RESI @ TMCx

740 scheduled meetings through the partnering system

68% between entrepreneurs and investors – the game is afoot!

15% between investors and other investors – syndicates are a growing trend and investors source syndication partners at RESI

12% between service providers and investors – CRO relationships are becoming more important to investors

5% between entrepreneur and entrepreneur – it’s a very small CEO universe

Quotes I heard at the event

Family Offices

A VP from a large family office (they invest up $100 million per deal) based in the Mid-Atlantic region who has been to last 5 of our conferences, stated he had 16 partnering meetings. The one thing he appreciated most was that the majority were from the Texas region – that’s why RESI was great for him. He has seen enough companies from Boston and the Bay Area. He was impressed that most Texas companies were far more realistic on valuations than those elsewhere.

An investor from a California-based family office who had never been to RESI before said “I go to many conferences across various industries and this was a great combination of useful topics and the kind of opportunities I want to see.”

Corporate VC

A corporate VC investor said he made one investment in a company he met at RESI@TMCx last year, and this year he found 2-3 he said he was very interested in pulling the trigger on.

A new corporate venture fund from the insurance industry said he needs venues like TMCx and RESI where he can find next generations solutions for all future applications, and also meet investors and strategic partners for corporate initiatives.

A VP of new technology at a corporation, who funded a company sourced from a previous RESI, described RESI@TMCx as a great venue for finding technology assets.

Seed Fund

Funded by two Chinese Pharma and a Chinese CRO looking for early stage investments, this fund’s founding came to TMCx to see what kind of regional technology she could find.

Pharma

A U.S. Pharma BD and Licensing lead said “RESI @ TMCx is great for showing what great resources are in regions like Houston. I have met several companies at RESI that I will continue to investigate.”

A VP of Outsourced Technology said “I need to find companies before they get tied up with long term VC relationships. RESI Houston enables me to broaden my view of companies in a region I need to canvass. I need to get to know these companies at an early stage.”

Tags: Houston, RESI, Texas, TMCx