By Dennis Ford, CEO, LSN

The single most important issue in the life sciences space today is that traditional sources of capital have slowed, creating a void, and fundraisers are left navigating using outdated maps & trying to play catch up. Anyone who has recently attempted to raise capital knows that this causes a lot of frustration and churn. Times have changed, and adjustments must be made. There is a distinct sentiment that the old funding models were broken to begin with (which I won’t belabor here), and the past investor segments aren’t going to return. The new landscape is substantially different, and new investor breeds are emerging across the space. Enter the Venture Philanthropist.

Venture philanthropists, or VPs, are extremely active investors and want to see results. However, this is not your typical exit-hunting venture firm; VPs mission is to speed up medical progress by eliminating the myriad of obstacles that researchers face, thereby hastening the delivery of breakthrough solutions to patients. Essentially, we’re talking about a mandate for medical progress and improved outcomes (hence philanthropy). VPs are impatient, and their goal is to accelerate the development of treatments and cures for the world’s most challenging diseases. There is a high degree of direct involvement as these investors are hands-on – they are more open, and therefore, flexible deal terms with multi-year allocation timelines can be negotiated. VPs know how to get things done, so expect milestones and carefully scrutinized metrics, along with action plans & organizational input.

VP firms provide funding for scientists and young life sciences companies in order to move along the development of therapies for certain diseases. Unlike traditional philanthropic organizations, venture philanthropists expect the companies and individuals they invest in to achieve certain milestones and focus on accountability. This isn’t just funding basic research; it’s driving products to patients as quickly and efficiently as possible.

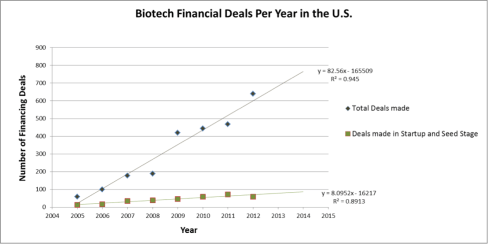

These investors are becoming increasingly important, especially due to many scientists’ inability to translate discoveries into compelling market opportunities, and because of impending cuts in the NIH budget, which could cripple future therapy development. Venture philanthropy currently only represents less than 3% of the spending on medical R&D in the US, but this figure is expected to grow as the need for funding from scientists and early stage biotech firms continues.

There doesn’t seem to be a global source on exactly how many of these Venture Philanthropist entities exist, although preliminary research indicates around 150 and growing. Both North America and Europe have burgeoning grassroots groups that are starting to organize and recruit fellow family offices, using the ideology of expediting science for the good of the world.

Tags: biotech, biotechnology, CMO, consulting, CRO, family offices, Fundraising, investor, Investors, issue, letter, life, Life Science, life science nation, medicine, nation, news, newsletter, pharma, Pharmaceutical, private equity, research & development, science, startup, venture capital